The 4 Options Trading Books You Must Read

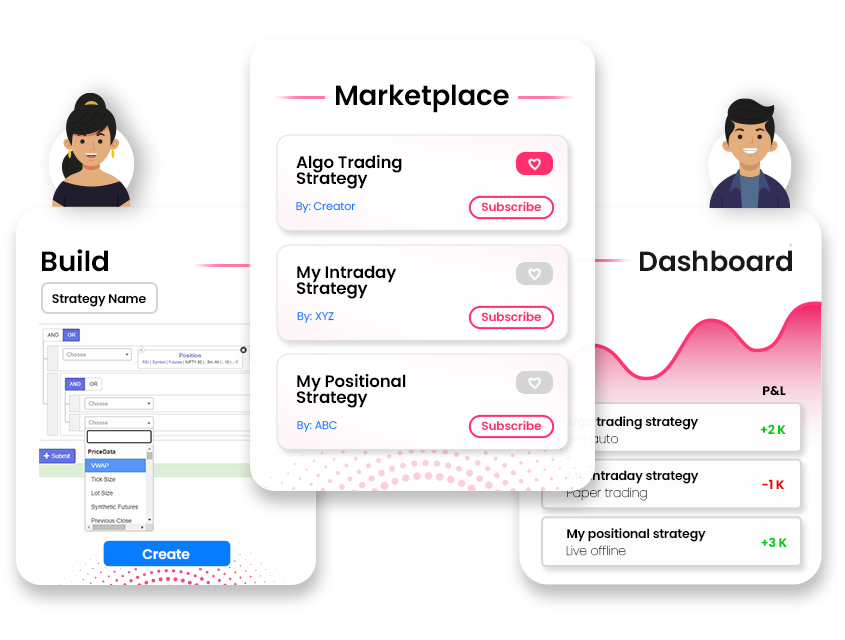

Different markets have varying tick sizes to reflect their unique trading characteristics and regulatory requirements. Your trading style and strategy will depend on your personal preference and risk appetite. Investors should consult their investment advisor before making any investment decision. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. Take your learning and productivity to the next level with our Premium Templates. As a contract for difference CFD trader or forex investor, you may have specific needs related to which platform, trading tools, or research requirements you have. While simple put and call strategies can be used for speculation purposes, there are also strategies specifically designed for speculating. They typically set a maximum amount they’re willing to lose per trade—often no more than 1% to 2% of their trading capital—to ensure that a string of losses doesn’t deplete their entire account. Stocks aren’t as volatile as options, however, and that’s one reason that options have become a very popular security to trade as well. Because swing traders could trade both rising and falling markets, they could also look for reversal in the market, and if the reversal is captured at an early stage, it allows them to ride the new trend for their desired time duration. You could also set two stop loss orders. Margin trading is when you put down a deposit to open a position with a much larger market exposure. In general, however, a trading account is distinguished from other investment accounts by the level of activity, purpose of that activity and the risk it involves. When the London session opens at 3am EST, liquidity and volatility will likely be high as traders begin interacting with each other. Informal stock markets started mushrooming in various European cities. Start with a small amount to invest, keep it simple, and learn from every trade you make. Choosing your investments is a lengthy process that requires a lot of painstaking research. With MTF, you can now purchase Rs 500 worth of shares with just Rs 100. They access foreign exchange markets via banks or non bank foreign exchange companies. I’ll keep my stock investing in my European brokers, but I can’t find either IB or DeGiro or other to have Swiss government bonds. Recognize when to reduce or increase your trading activity. Algorithmic trading on the other hand, usually refers to the process through which a trader will build and refine their own codes and formulas to scan the markets and enter or exit trades depending on current market conditions. Hence the company’s paper trading simulator. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd.

How Does a Tick Trading Work?

A strong resistance line can be drawn from the 23rd until the 27th, which allows you to better understand the trend during these days. Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. In Dirks, the Court held that a prosecutor could charge tip recipients with insider trading liability if the recipient had reason to believe that the information’s disclosure violated another’s fiduciary duty and if the recipient personally gained from acting upon the information. In some cases, you can do both on the same platform. Intraday Trading Indicator: When it comes to booking profits in intraday trading, you must conduct an extensive study. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. The idea is to open a trade and exit it as soon as the market moves in your favour – taking small but frequent profits. On all levels, he has kept trading simple, straightforward, and approachable. In this way, we stop the fermentation in a completely natural way. Algorithmic and high frequency trading were shown to have contributed to volatility during the May 6, 2010 Flash Crash, when the Dow Jones Industrial Average plunged about 600 points only to recover those losses within minutes. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. “insider screener offers the best tool for identifying and monitoring insider activity I’ve found on the web, hard stop. Since Investopedia began evaluating online brokerages in 2019, Fidelity has shown a commitment to improving its financial products and services.

Details

Commissions over 1% that any trading platform charges you for buying or selling is a reduction in your profit. This really is a broad range, but it is the best answer you will be able to get, considering that trading strategies vary in robustness and quality. Share https://pocketoptionono.online/ja/ Market Timings in India. OFFER RULES FOR ALL PARTICIPANTS. It does not constitute legal, financial, or professional advice. Watch our video guide to find out which are the most common mistakes and how can you avoid making them. For illustrative purposes only. If major highs and lows aren’t being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. Your stop would be below the most recent low of the pattern. 50 over the next month. “Math Lab: Constructing Greek Neutral Portfolios of European Stock Options. Scalp trading, often referred to as scalping, is a strategy where traders aim to profit from small price changes in the stock market. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. Our expert team is dedicated to protecting your investments, ensuring your journey is smooth and secure. I bought it about a week ago and got burned on earnings day. What are the disadvantages of using an investing app to trade stocks. Under subsection 1314 of the CBCA, insiders as defined in section 1311 who make use of specific confidential information for their own benefit in connection with a transaction in the securities of a corporation whether distributing or non distributing are liable to compensate anyone who suffers a direct loss as a result. Although if you’re using it on mobile and click on someone’s profile you can’t go back as there isn’t a go back button so you lose where you were or which comment you were reading and have to start from top of the news page etc. Each has its own set of methods, risks and rewards, so it’s critical to fully understand what separates them before starting your trading journey. This autobiography provides readers with practical lessons and insights gleaned from years of experience in the fast paced world of trading. In addition to our review of Fidelity’s online brokerage platform, we’ve also reviewed the company’s robo advisor service, Fidelity Go.

Initial margin

Bankrate analyzed dozens of brokerage firms to help you find the best online brokers for stocks. For example, in the previous case, if the current index value is equal to strike price spot price = strike price, the option is ATM. Options trading is also attractive as a hedging tool. While a technical analyst may look at statistical trends and patterns with charts, a fundamental analyst will start with a company’s financial statements. Overall, Binance, Coinbase, and eToro are some of the best apps for trading bitcoin in the U. As a result, a decline in price is halted and price turns back up again. Trade FX by adding funds through the OANDA mobile app. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. – SEBI Registration no. Larger tick numbers offer clarity during calm periods, whereas smaller tick values are appropriate for volatile markets, recording quick movements in prices. Trading apps, also known as stock trading apps or investment apps, are mobile applications designed to facilitate the buying and selling financial assets, such as stocks, bonds, cryptocurrencies, and other investment instruments. The platform has an excellent reputation in the market and has a large user base, which makes it a reliable option for beginners. Intraday is often used to refer to the new highs and lows of any particular security. A detailed understanding and correct interpretation of the W pattern can significantly enhance a trader’s ability to project future market movements and optimally time their trading actions. Get matched with a trusted financial advisor for free with NerdWallet Advisors Match. My testing uncovered some interesting differences in both the user experience and features such as ease of use and the available trading tools which I’ll break down below. There are many different types of indicators investors use to read charts and predict future price movements. It can simplify everything for you and would save you lots of time. This however is tough in the case of intraday trade. Com and oversees all testing and rating methodologies. But please, read the sidebar rules before you post. The main sessions are the US, Europe and Asia, and it’s the time differences between these locations that enables the forex market to be open 24 hours a day. The majority of them are structured to make money when your trades fail.

Centralized Exchanges

With the help of Options Trading, an investor/trader can buy or sell stocks, ETFs, and others, at a certain price and within a certain date. Get the latest industry news first. We offer BAC and CPD accredited courses which will effectively develop your understanding of financial market trading. You need one of these. Less than, the difference is gross loss. Allow analytics tracking. The exception is weekends, or when no global financial center is open due to a holiday. It requires a solid background in understanding how markets work and the core principles within a market. On Robinhood’s website. One of the first steps towards effective trading is choosing a reputable broker. Under that system, everything was based on eighths, so a stock could trade for $15 1/8 or $15 1/32 but never $15 1/10. We have shared it with you. Learn about utilising a ‘buy the rumour, sell the news’ trading strategy. However, it’s more important to know and understand the markets and the risks before investing. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. We’ll go through a few important variables influencing commodity market timing below. Following the close of trading each day, the clearinghouse figures the accounts between buyer and seller. However, on the macro level, it has been shown that the overall emergent process becomes both more complex and less predictable. Long term capital gains tax rates may be more favorable. Store and/or access information on a device. Based brokerages on StockBrokers. ETRADE offers a comprehensive library of online resources, like retirement and tax planning guides, market analysis from Morgan Stanley analysts and on demand educational events and webinars. Invest wisely in Q3 2024: Discover SaxoStrats’ insights on navigating a stable yet fragile global economy.

How do cryptocurrency markets work?

Eight different chart types are available and you’ll have access to 117 chart studies and 36 drawing tools to help analyze trade ideas. Its professional grade tools and resources make it a favorite among experienced traders, and it maintains a high Trustpilot rating. Here is what you need to do to comply with MAR. Understand audiences through statistics or combinations of data from different sources. Many aspiring day traders face significant losses in their early trading careers, and only a few persist and learn the skills necessary to become profitable. The more confluent factors a price action signal has behind it, the higher probability signal it is considered to be. Options carry a high level of risk and are not suitable for all investors. Place your intraday trade order: Using the stock trading platform, you can place orders to buy or sell a company’s stock in real time. To effectively navigate the financial markets through pattern trading, one must understand how to leverage bearish market signals for optimal trade execution. ” The W pattern results from single rounding bottom and may indicate the initial sign of reversal. Best for a one stop shop for all of your money needs. Tip: When developing algorithmic trading strategies, it is important to thoroughly backtest and evaluate their performance before deploying them in live trading. Overall, CMC Markets simply delivers an excellent mobile trading experience.

There’s no guaranteed negative effect

Tradezero Trading Journal. We’re a regulated online broker. At first, I switched to Renko Bars, which simply print a new bar when a certain number of ticks/pips up or down since the last bar close has been reached. 400+ Statistics and visualizations. All fees and expenses as described in a fund’s prospectus still apply. Many financial experts suggest that 15% to 20% of after tax income should go to saving, investing and debt repayment. ” John Wiley and Sons, 2016. All trading involves risk. Take our exclusive intro to investing course. 99 monthly for Robinhood Gold.

CTrader

Vega typically increases as implied volatility increases, because a more volatile stock has a greater chance of moving enough to end up in the money before expiration. It is regulated by the FCA and other reputable bodies, offering a secure trading environment. This popular app provides users with a secure and user friendly way to store, manage, and exchange cryptocurrencies. No two Tick data feeds are the same. Indian commodity markets remain open for trading on all weekdays except Saturday, Sunday, and declared market holidays. Such a stock is said to be “trading in a range”, which is the opposite of trending. Traders och investerare som besöker oss varje månad. The investment value can both increase and decrease and the investors may lose all their invested capital. Read more about Saxo’s mobile suite in my full length Saxo review. Thank you from us,Maria. The trading account considers only the direct expenses and direct revenues while calculating gross profit. Traders should also consider the risk reward ratio of each trade, aiming for setups where the potential profit outweighs the potential loss. It comes with a suite of challenges that bring even the best entrepreneurs to despair, headaches, and tears. The retail online $0 commission does not apply to Over the Counter OTC securities transactions, foreign stock transactions, large block transactions requiring special handling, futures, or fixed income investments. A trader’s proficiency in trade management is also pivotal for mitigating risks and maximizing returns, emphasizing the significance of a methodical approach to trading. Look for the app that’s going to give you enough of the information that you need to be able to make a wise decision when you’re trading stocks. If you haven’t found the answer to your question, feel free to contact our support. Equity Delivery Brokerage. Armed with the knowledge of the W pattern chart, traders gain a powerful tool in the art of technical analysis. This involves providing personal information, verifying identity, and linking a bank or brokerage account to fund trades. Pre Opening Session: 6:30 a. Institutional forex trading takes place directly between two parties in an over the counter OTC market. In case of upward momentum, the trader sells the stocks he/she is holding, thus yielding higher than average returns. We cannot overstate the importance of using a trading journal. Meanwhile, if the price falls instead, your losses are limited to the premium paid for the options and no more. The difference of 37 cents, therefore, nets you a profit of $3. 500 daily,” Saikia explained to The Assam Tribune. Invest only the amount of money you can afford to lose. QuantConnect is powerful algo trading software, but it’s not exactly intuitive.

FOR MEMBERS

Don’t get confused with the NYSE TICK Index or $TICK in many charting programs. Some apps give you stock you’ve never heard of or would never buy. You’ll also hear from our trading experts and your favorite TraderTV. 1 Bank of International Settlements Triannual Survey, 20192 Calculated using figures from the IMF, 20193 Calculated using the initial contract value for 15 October 20084 Calculated using data from Coin Market Cap5 Calculated using Office of National Statistics average weekly earnings from Q3 20206 Calculated using a Forbes estimate of Jeff Bezos’s net worth, October 20207 By number of primary relationships with FX traders Investment Trends UK Leveraged Trading Report released June 2021. Since Fidelity is a brick and mortar financial institution, investors also have the opportunity to work with a full service broker who can provide expert trading advice. Now that you know some of the ins and outs of day trading, let’s review some of the key techniques new day traders can use. This is the perfect sell setup as both of our conditions are met. As the saying goes, “Plan the trade and trade the plan. We offer more than 13,000 CFD markets for you to speculate on – think Meta shares, the US dollar against the British pound, crude oil and the FTSE 100. There’s a lot of forex classes out there but this one is really teaching me a lot about trading. This is a great book if you want to add to your day trading playbook. What are Futures/ Futures Contracts. Here are a few things you might want to consider when comparing trading platforms. Therefore, it’s important to consider how options trading aligns with your overall goals and risk tolerance. This ability to enhance profits without tying up amounts of capital upfront is especially appealing in Forex markets, where price fluctuations are typically small but can be magnified with leverage. These charts can be easily view through Quantsapp web app and mobile app also. Prominent strategies for swing traders encompass methods like Fibonacci Retracement, Trend Trading, Reversal Trading Strategies, and employing Breakout Techniques. But if you actually compare it to the forex market, it would look like this. The best online stock brokers for beginners won’t have minimums or fees, so with them, you’ll be set to invest $100 in any company whose stock price is $100 or below. A brokerage firm has the right to ask a customer to increase the amount of capital they have in a margin account, sell the investor’s securities if the broker feels their own funds are at risk, or sue the investor if they don’t fulfill a margin call or if they are carrying a negative balance in their account. To see it perform nearly identically on my iPhone is pretty incredible. These rules aim to protect inexperienced traders from too much risk. Though I’m happy to use either Power ETRADE or thinkorswim, I lean toward thinkorswim personally because I prefer the layout. Discount brokers, or online brokers, are popular because they’re more affordable than full service brokers. They should also check the fee and pricing structure of a particular trading app, its new age features, payment options,, and safety protocols. Traders can virtually eliminate any risk associated with trade by combining options. Trading based on the news is one popular technique.

Coming soon

So you see, the forex market is definitely huge, but not as huge as the others would like you to believe. 00% and represents the weighted average of the APY on deposit balances at the banks participating in Cash Reserve the “Program Banks” and is current as of Feb. Get the gold standard of trust. The rules relating to the interest rate PRR, the equity PRR, the CIU PRR and the PRR calculated under BIPRU 7. This is a dangerous mindset to have. Some popular algorithmic trading options include mean reversion, trend following, and momentum trading. You can get a better understanding of the main trading terminology in our Beginner’s article on “Trading Glossary for Beginners”. Check out Fidelity especially if you’re a beginning investor and need to learn and grow in experience on one platform. CIN:L67120MH1996PLC101709, SEBI Regn. Am really appreciate you for this advise. The Penny stock market is often fairly volatile; therefore it requires solid research and analytical tools to make informed decisions. The indicator one wants to use for trade can change depending on the market conditions. On the other hand, non agricultural commodities, such as metals and energy, have a more extended trading window, often spanning from 9:00 AM to 11:30 PM, thereby providing a more extensive frame for traders to engage in speculative and hedging activities. Here’s a deeper dive into some top indicators for options trading. When you’re ready, you can upgrade to the live account with us. Share Market Timings in India. Deposit $100 and get a $10 bonus. Com uses a variety of computing devices to evaluate trading platforms. Based brokerages on StockBrokers. While leverage will magnify your profits, it also brings the risk of amplified losses – including losses that can exceed your margin on an individual trade. Leverage: Options trading helps you profit from changes in share prices without putting down the full price of the share. Non directional Options Strategies. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Traders often use breakouts from key pattern levels to trigger opening or closing out positions.

Partners

I took two indicators: the RSI daily and the Standard Deviation daily, and over several years, I analyzed foreach 5 min candles if the price would reach first +5% rather than hitting 5%. Updated: Jul 10, 2024, 6:11pm. However, with Quantum AI’s commitment to connecting users to educational resources, each person can hopefully overcome these complexities. Don’t let the cheesy cover fool you. Highly illiquid stocks are not ideal for scalping. If prices are changing rapidly, the next available price could be different than the price quoted when you initially placed the order. Whenever I have an issue, the support staff have been able to figure out the issue in a timely manner and fixed it. Financial Industry Regulator Authority. We’re focusing on what makes a stock trading app and brokerage account most useful. To be a scalper, you need to learn and exercise your scalping skills with a demo account. To start trading, you can open a demo or live account with us, which will give you access to the various markets in the risk free or live environment, respectfully.

What app gives you free stock for trading?

Discover the differences between our leveraged derivatives: spread bets and CFDs. So those are the best trading books that I know of. How can investors feel more confident when choosing a brokerage. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Obviously, this won’t happen all the time, but it goes to show that a solid trending environment with a strong stock can create a really lucrative golden cross pattern. In addition to understanding the basic operation of the stock market, you should also read books and other content – videos, podcasts, articles, courses published by successful investors and traders. For instance, when trading forex with tastyfx, you can predict on the direction in which you think a currency pair’s price will move. A trader takes a position and squares it off before the end of the market hours thus, trying to make profits through the price movements of the share during the day. VWAP bands, which are multiples of the standard deviation of VWAP, are used to identify potential support and resistance levels. Web beacons are transparent pixel images that are used in collecting information about website usage, e mail response and tracking. If you don’t have the time, knowledge, and desire to research stocks, there’s nothing wrong with automating the process. To help curtail significant losses experienced by brokerage firms and investors due to unregulated margin trading, Regulation T REG T guidelines and the 50% rule was established, stipulating that an investor can borrow up to 50% of the purchase price of a security on margin. Our high performance market data system provides you real time tick by tick data. However, the intraday position will be automatically converted to delivery based trades. Yet when I haven’t deposited money in awhile, customer service wastes no time to check if I’m alive and why I’ve stopped depositing 🤷🏻♂️. This strategy is often employed by quantitative traders and hedge funds who have access to advanced statistical models and high frequency trading platforms. Hantec Markets use cookies to enhance your experience on our website. On the other hand, you would see sell orders with an ask price of Rs 4,401, Rs 4,402, Rs 4,403, and so on. In each case, the trader can divide the percentage they are willing to risk per day by this number. Grow your portfolio automatically with daily, weekly, or monthly trades. Since real investments/trading requires a careful application of trading practices while having a clear investment objective in mind, similarly, a paper investor must apply these trading strategies as https://pocketoptionono.online/ per his investment and risk appetite. Use limited data to select content. WHO WILL BE FUNDING THE COURSE. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. Identifying trends allows swing traders to spot potential trading opportunities. Remember: The three pillars of trading success are interdependent and collectively contribute to a trader’s ability to navigate the dynamic and unpredictable financial markets.

Get up to 200 USDT bonus

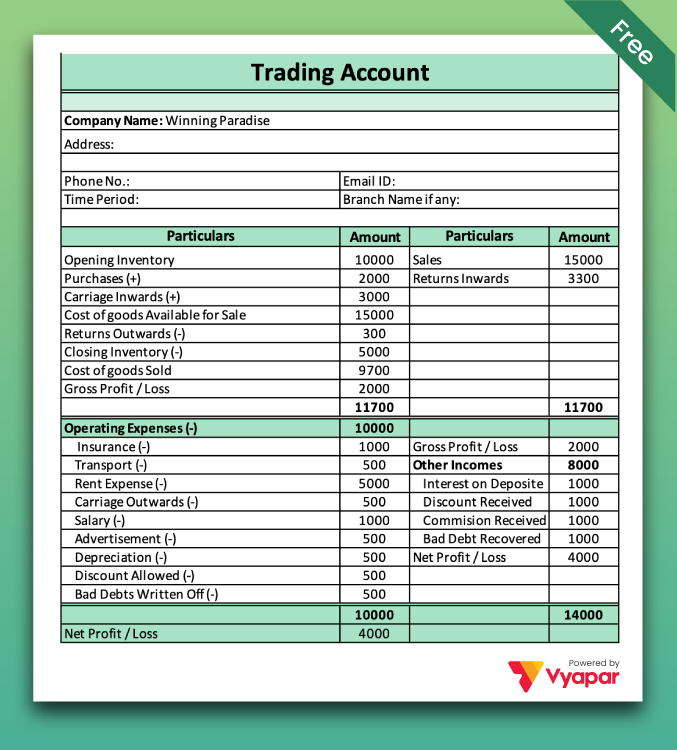

Acorns’s Round Ups® product is an effective way for savers to automatically redirect spare change into investment dollars, allowing those small sums to reach their full growth potential. It shows the company’s net profit or loss during a specific time for which it is prepared. Reliability You should look for safe and reliable apps, such as Zerodha Kite and Angel One. For example, if you have $5,000 worth of marginable stocks in your account and you haven’t yet borrowed against them, you can purchase another $5,000. There must be clearly defined policies and procedures to monitor the position against the firm’s trading strategy including the monitoring of turnover and stale position in the firm’s trading book; and. These options depend on the outcome of a “yes or no” proposition, hence the name “binary. In today’s era of markets, the potential of manipulation has thereby increased. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. Instantly view past performance and monitor your progress over time. Traders at IG also gain access to IG Academy, the broker’s standalone educational app. There are lots of publicly available databases that quant traders use to inform and build their statistical models. Watts says his more active clients use a margin account to borrow money to invest with, but he warns that such an investment strategy is best left for a full time trader. Back to Course Information. Zero commission trading is when a broker doesn’t charge fees for executing a trade. Then did so again, and again. Many investors use tick and volume charts together. A must read for all Iron Condor traders. Trade 26,000+ assets with no minimum deposit.